On the evening of July 9, Shanshan. The company released its 2024 semi-annual performance forecast. It is expected to earn a net profit of 15 to 22.5 million yuan. After deducting one-time gains and losses, the net profit will be 16.5 to 24.75 million yuan.

The company expects a net profit of 88.28 to 95.78 million yuan in the second quarter of 2024. After deducting non-recurring gains and losses, the profit will be 89.85 to 98.10 million yuan. This is better than the first quarter.

In response to performance changes, Shanshan Co., Ltd. The industry is the company’s core business. It is still in an adjustment period. Product prices are under pressure and industry profits have fallen year-on-year. Changes in industry prosperity affected them. The net profits of the negative electrode materials have declined year-on-year. The same is true for the polarizer businesses.

Also, the company kept advancing its focus strategy. But, selling off non-core businesses hurt the company. Making impairment provisions for related assets hurt it, too. At the same time, the company sold part of the equity of the electrolyte business last year. It made an investment income of about RMB 244 million. But, there was no investment income from this business in the current period.

Industry insiders pointed out that the most difficult time for the negative electrode industry may have passed.

In the first half of this year, industry destocking advanced. Sales were strong in the domestic new energy vehicle market. As a result, the anode industry showed signs of slight improvement. Several anode material companies have revealed that order demand is growing. They said that they are using most of their capacity.

Shanshan Co., Ltd. They said that the company’s anode material business has had a big increase in sales. They did this by entering new markets. They also improved their customer mix. They formed strong ties with major industry customers. They also kept a lead in improving their products. In the second quarter of 2024, orders were full. Sales rose a lot from the previous quarter. At the same time, the company cut costs and increased efficiency. The net profits in the second quarter also rose significantly from the previous quarter.

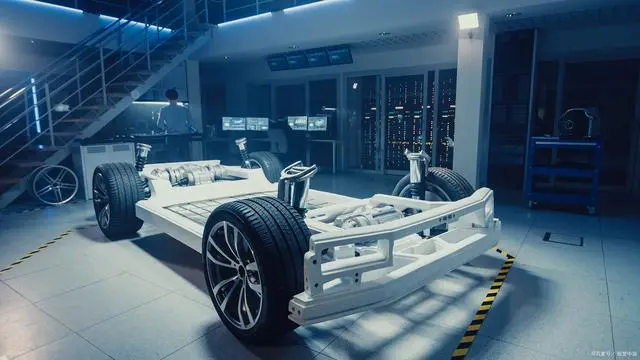

Solid-state batteries are regarded as the next generation of battery technology. The new technology requires new anode materials and also brings high premium. Among them, silicon anode is the key direction for the layout of anode material companies.

Shanshan is a leading company in anode materials. It has researched and developed silicon-based anodes since 2009. It is a leader in vapor deposition silicon carbon anode technology. Shanshan’s new silicon carbon products have kept a lead in customer tests. They are intended for a new generation. The core technology has obtained patents from the US and Japan. It plans to start mass production in August 2024.

At the same time, Shanshan has also made breakthroughs. They are at the core of batch synthesis tech. It makes silicon-based negative electrode materials. We have supplied silicon-oxygen products to leading overseas customers in batches. They have installed them on vehicles. It has also solved the problem of circulating second-gen silicon-oxygen at low temperatures. It has entered the supply chain of global high-quality electric tool makers. Shanshan has achieved batch supply of silicon negative electrodes. Now, they plan a 40,000-ton silicon negative electrode base in Ningbo.

Experts predict silicon-based battery anodes will soon enter rapid industrial adoption. Companies that position themselves early in this field may gain a competitive advantage. Cheaper silicon and better technology are changing how power batteries are made. (Source: Shanshantong)

We understand that Shanshan’s annual production is 100,000 tons. The project is for negative electrode material in Finland. It is Shanshan’s first project in the industry to go overseas. The project is divided into two phases, and the production capacity of each phase is 50,000 tons/year. The first phase will take 24 months to build. The whole project may take 48 months to build. This scale and layout will surely boost Shanshan’s competitiveness. They will do so in the global market for battery negative electrode materials.

After the project, the company will benefit. It should improve its overseas production layout. This will let it meet the needs of downstream customers and foreign market expansion. It will also help the company expand its global market. It will also help the company grow its global market share. This will further solidify its leading industry position. At the same time, the project process route has been verified by the existing production base. It has been improved after adding feedback from high-quality domestic and foreign customers. After the project, the company should boost its global production scale. This will be a benefit.