Im Jahr 2024 wird es bei Kathodenmaterialien ein Ungleichgewicht zwischen Angebot und Nachfrage geben. Aufgrund eines Preiskampfs zwischen den großen Automobilherstellern ist der Einsatz von ternären Lithiumbatterien zurückgegangen. Im Gegensatz dazu ist die Nachfrage nach Lithiumeisenphosphatmaterialien sprunghaft gestiegen. Ihre Verwendung ist rasant gestiegen. Gleichzeitig ist Lithiumeisenphosphat zum „König des Königs des Volumens“ geworden.

Entweder höher, niedriger oder nachhaltiger! Einige Unternehmen haben bereits geschrien: „Bereiten Sie sich auf 10 Jahre Verluste vor.“

Eine neue Runde der Beseitigung industrieller Modernisierungen im Jahr 2024 hat begonnen! Wohin wird es im Jahr 2025 gehen?

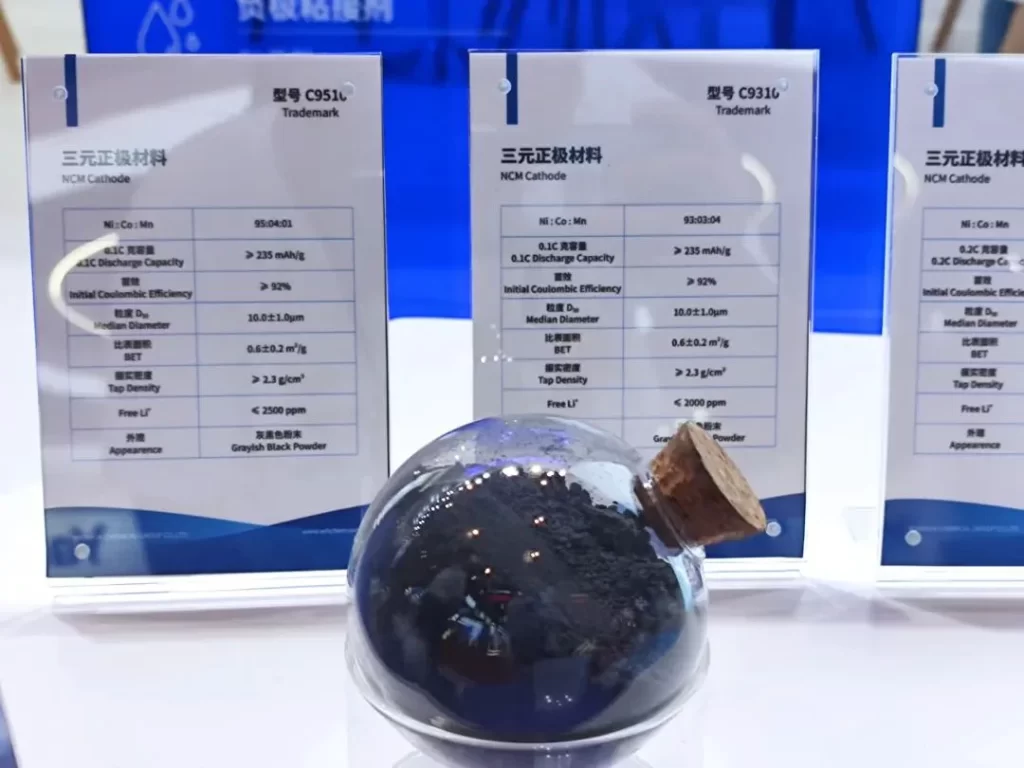

Ternäre Materialien: Kostenunterstützung, Stop-Loss und Gewinnmaximierung

Im Jahr 2024 ist die Leistung der ternären Materialien zunächst besorgniserregend, dann stabil. Im ersten Halbjahr ist es noch „halb profitabel und halb Verlust“. In der zweiten Jahreshälfte, wenn sich die Preise erholen, wird es allmählich aufhören, Geld zu verlieren und sich in Gewinne verwandeln.

Daten zeigen, dass Lithiumbatterien von Januar bis November 2024 eine Kapazität von 473 GWh hatten. Dies ist ein Anstieg von 391 TP3T gegenüber dem Vorjahr. Beliebt ist nur Lithiumeisenphosphat. Der Anteil ternärer Lithiumbatterien ist gesunken.

Aufgrund des langsameren Nachfragewachstums stagnierten die Preise für ternäres Kathodenmaterial. In der zweiten Jahreshälfte zeigten sie Anzeichen einer Stabilisierung. Ternäre Materialien können in großen Mengen produziert werden. Es gibt jedoch wenig neue Kapazitäten. Die Preise bestehender Unternehmen sind aufgrund der Kosten und der Branchenkonsolidierung niedrig. Da kostengünstige Fahrzeuge mit alternativer Energie den Markt überschwemmen, können ternäre Lithiumbatterien nicht davon profitieren. Führende Unternehmen für ternäre Materialien wie Dangsheng und Rongbai haben ausländische Märkte im Auge.

Lithiumeisenphosphat: Verrückter interner Wettbewerb und falsche Preiserhöhungen

Lithiumeisenphosphat steht derzeit im Rampenlicht, da sowohl die Nachfrage als auch das Angebot hoch sind. Dies ist besser als ternäre Materialien. Der Aufstieg von Wärmepumpen-Klimaanlagen hat Lithiumeisenphosphat-Batterien verbessert. Ihre Leistung bei niedrigen Temperaturen ist besser. Auch die Batterietechnologie und die Wärmemanagementsysteme haben sich weiterentwickelt. Infolgedessen werden diese Batterien in mehr Elektrofahrzeugen verwendet. Ihre Haltbarkeit bei niedrigen Temperaturen ist jetzt höher und es sind mehr Modelle mit ihnen erhältlich.

Im 1. und 3. Quartal 2024 stiegen die Lithiumpreise. Daher musste die Lithiumeisenphosphatindustrie ihre billigen Lagerbestände auffüllen. Der Produktionsplan und die Betriebsrate der Lithiumbatterieindustrie erholten sich allmählich. Die Produktion und Produktionskapazität von Lithiumeisenphosphat sind seit letztem Jahr stark gestiegen. Im 1. und 3. Quartal 2024 produzierten Lithiumeisenphosphatbatterien das Doppelte ihrer installierten Kapazität. Dies war höher als die Gesamtmarktnachfrage. Es gab ein gewisses zeitliches Missverhältnis zwischen Angebot und Nachfrage. Die Branche ist dabei, ihre Lagerbestände abzubauen. Sie steht unter starkem Druck, Kosten zu senken.

Im Jahr 2024 wird die Produktionskapazität für Lithiumeisenphosphat 5,2 Millionen Tonnen betragen. Die tatsächliche Produktion wird 2,4 Millionen Tonnen betragen. Die Kapazitätsauslastung wird also unter 50% liegen.

Im Jahr 2024 wird Lithium-Eisenphosphat ein sehr komplexer Typ von Lithium-Batterie sein. Absolute Überkapazitäten werden zu einem unauslöschlichen Schatten auf Produktpreise und Unternehmensgewinne.

Aktuelle Entwicklungen bei Lithium-Eisenphosphat-Materialien

Die Lithiumeisenphosphat-Industrie hat an Popularität gewonnen. Einige hochwertige Lithiumeisenphosphat-Produkte sind mittlerweile knapp. Einige Unternehmen stehen kurz vor der Vollproduktion und die Preise sind gestiegen. Dies ist hauptsächlich auf die höhere Nachfrage nach Produktverdichtung zurückzuführen. Außerdem führten Prozessverbesserungen zu einer „falschen Preiserhöhung“.

Lithiumeisenphosphat-Materialien können einmal gebrannt werden. Um die Energiedichte zu erhöhen, rüsten Hersteller jetzt das erste auf ein zweites Sintern auf. Dies erhöht die Verdichtungsdichte der Materialien. Dies erhöht die Kosten und die Auslastung der Linie erheblich. Die ursprüngliche Produktionskapazität entspricht 50% weniger. Wenn jedoch eine Tonne Material erneut gesintert wird, wird eine zusätzliche Gebühr von 2.000 Yuan fällig. Es scheint also, dass der Preis für Lithiumeisenphosphat-Materialien um 1.000 bis 2.000 Yuan steigt. Aber der Preisanstieg kann die höheren Kosten nach dem „zweiten Brennen“ nicht ausgleichen.

Es scheint, als würde sich die Branche erholen und die Produktpreise steigen. Doch im Geheimen hat eine neue Runde von technischen Upgrades und Preissenkungen begonnen. Dies wird im Jahr 2025 zu einer Situation führen. Große Unternehmen könnten dann in Verlegenheit geraten. Sie müssen möglicherweise mehr investieren, die Produktion ausweiten und Produkte aufrüsten. Aber sie werden kein Geld verdienen. Dieses Ausscheidungsspiel hat sich plötzlich verschärft.

An beide Enden gehen: High-End-Hochleistung, Low-End-Kostenleistung

Die Industrie für Materialien für positive Elektroden von Lithiumbatterien steht an einem Wendepunkt. Es besteht eine hohe Nachfrage nach ternären Materialien, aber die Kosten sind hoch. Daher verfolgen die Entwickler zwei Extreme: „High-End-Materialien mit hoher Leistung“ und „Low-End-Materialien mit Kosteneffizienz“.

Ein Ziel ist es, von Hochleistungsprodukten zu profitieren. Dazu gehören halbfeste Batterien mit hohem Nickelgehalt, große zylindrische Vollohrbatterien sowie High-End-Werkzeuge, elektrische Supersportwagen und fliegende Autos.

Die andere Richtung besteht darin, am Preis-Leistungs-Verhältnis festzuhalten. Es geht darum, Lithium-Eisen-Mangan-Phosphat-Materialien zu entwickeln und „neue Zweige“ auf der Basis von Mangan-Materialien zu eröffnen. Nach der Massenproduktion wird Lithium-Eisen-Mangan-Phosphat das Beste für EV-Batterien sein. Es wird die Vorteile von ternären und Eisen-Lithium-Batterien haben, aber fast keine ihrer Nachteile.

Bei Lithiumeisenphosphat müssen sowohl die Herstellung als auch die Kosten verbessert werden. Da die Optimierung auf Materialebene an ihre Grenzen stößt, konzentrieren wir uns auf die Optimierung des Prozesses. Jetzt zielen wir darauf ab, Ausrüstung und Prozesse zu optimieren. Wir nutzen auch sekundäres Sintern, um den Materialverbrauch zu verbessern. Ein neuer Ansatz besteht darin, Lithiumcarbonat durch Lithiumdihydrogenphosphat zu ersetzen, um Energieverbrauch und Emissionen zu senken.

Marktprognose für Kathodenmaterialien für Lithiumbatterien im nächsten Jahr

Eine aktuelle Umfrage zeigt, dass im nächsten Jahr eine starke Nachfrage nach Preiserhöhungen besteht. Die Fabriken für positive Elektrodenmaterialien wollen eine Erhöhung um etwa 3.000 Yuan/Tonne. Die Batteriefabriken werden jedoch wahrscheinlich nur eine Erhöhung um 1.500 Yuan/Tonne akzeptieren, also die Hälfte des geforderten Preises.

Vorläufige Ergebnisse zeigen, dass Lithiumcarbonatfabriken die langfristigen Rabatte für das nächste Jahr gekürzt oder beendet haben. Außerdem steigt der Preis für Eisenphosphat-Rohstoffe. Phosphatfabriken haben eine klare Haltung zur Preisunterstützung. Man kann davon ausgehen, dass die Preise für Lithiumeisenphosphat-positive Elektrodenmaterialien steigen werden. Der Schlüssel ist die endgültige Preiserhöhung.

Aus der detaillierten Analyse geht hervor, dass Produkte mit einem Pulverdruck von 2,45 und 2,50 den größten Marktanteil haben. Aufgrund ihrer Homogenität und niedrigen technischen Schwelle wird es schwierig sein, die Tatsache der Verluste zu ändern.

Produkte mit hohem Pulverdruck (dreieinhalb Generationen und mehr) haben jedoch einen geringen Marktanteil. Die hohe technische Hürde und die Produktenergiedichte werden die Nachfrage ankurbeln. Fabriken, die Materialien für positive Hochdruckelektroden herstellen, werden an Verhandlungsmacht gewinnen. Sie sollten in der zweiten Hälfte des nächsten Jahres in der Lage sein, Verluste in Gewinne umzuwandeln.

Der Eisen-Lithium-Markt wird sich im nächsten Jahr stabilisieren und wachsen. Aber das Frühlingsfest und die hohen Lagerbestände im Jahr 2024 werden Angebot und Nachfrage Anfang 2025 schwächen. Die zweite Hälfte des Jahres 2025 dürfte stark sein.